Forex trading is the world’s largest financial market. It moves more than $6.6 trillion every day. Unlike the stock market, Forex has no central exchange.

It runs 24 hours a day, 5 days a week, across different time zones worldwide. Because of its non-stop nature, success depends on more than just the understanding of price charts.

You also need fast execution, stable connections, and a reliable trading infrastructure, such as a Forex VPS hosting. This guide further breaks down what Forex is, how it works, and the tools traders use to stay ahead.

What Is Forex Trading?

Forex trading is buying one currency and selling another at the same time. Think of yourself swapping dollars for euros at the airport, except you’re not heading out on a vacation. You’re instead trying to profit when the exchange rate moves in your favour.

The goal is simple – buy low, sell high.

Traders usually keep a close eye on exchange rates, waiting for the perfect moment to jump in or cash out. Most do this through a forex trading platform, basically a software that links you to the market and lets you execute trades in seconds.

How Does The Forex Market Work Globally?

Unlike stocks traded on exchanges like the New York Stock Exchange, forex has no central hub. It’s spread out across the globe and operates 24 hours a day, five days a week, since someone somewhere is always trading currencies.

Here’s how the global forex market operates throughout the day:

˃ Sydney Market Begins Operations

A regular trading day starts in Sydney, Australia. This marks the start of the session, usually calmer but definitely active.

˃ Tokyo Takes Over

A few hours later, Tokyo opens. The Japanese yen sees heavy trading here, and this session brings more volume and movement.

˃ London Opens (Biggest Session)

When London wakes up, things get busy. The London session accounts for the largest share of forex trading volume globally. Many major currency pairs see significant movement here.

˃ New York Joins In

As London traders are in full swing, New York opens. This creates an overlap where both markets are active at the same time. This overlap is when the most volatility and trading opportunities happen, especially for pairs like EUR/USD and GBP/USD.

˃ The Cycle Repeats

After New York closes, Sydney opens again, and the cycle continues. The market never truly sleeps.

The Problem for Home Traders:

Since the market runs 24/7, big price moves can happen at any time, even at 3 AM your time. If you’re trading from your home computer and you’re asleep, you miss such opportunities.

You might also miss a chance to close a losing trade before it gets worse. This is exactly why professional traders use BigCloudy VPS hosting.

A VPS keeps your trading platform running around the clock, even when you’re offline. Your automated strategies keep working, your trades stay protected, and you never miss a market-moving moment while you are asleep.

Key Forex Facts: Pips, Spreads, and Latency

Every forex trader needs to know three fundamental concepts that directly affect profits and trading performance.

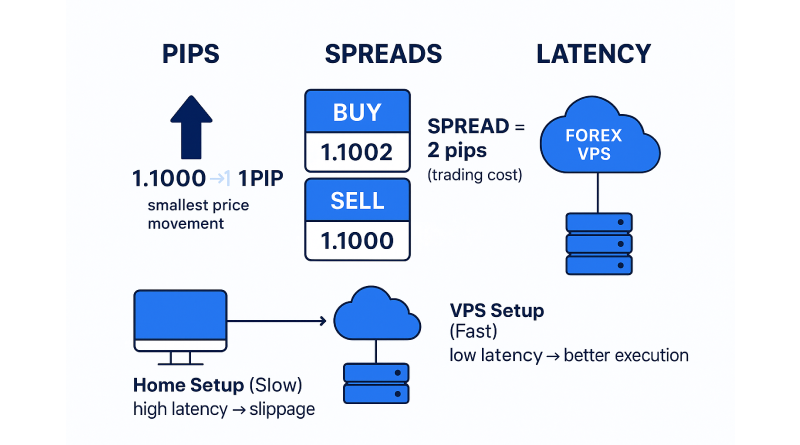

Pip:

The spread is what you see between the buy price and sell price of a currency pair. Think of it as the fee you pay just to get into a trade. Traders hunt for brokers with narrow spreads because lower costs mean more money stays in their pocket.

Spread:

The spread is the difference between the buying price and selling price of a currency pair, essentially the cost you pay to enter a trade. Traders prefer brokers with tight spreads because they cut costs and boost profits.

Latency:

Latency measures how fast your trade order zips from your computer to your broker’s server. When latency runs high, you get slippage. That means your order fills at a worse price than the one you clicked, turning would-be winners into losers. A specialised Forex VPS reduces latency to milliseconds by placing your connection directly next to the broker’s server.

Types of Forex Trading (And Required Tools)

Each trading style needs its own mix of tech, automation, and reliability to pull off properly.

Manual Trading

This is traditional trading where you personally analyze charts, news, and indicators to make trading decisions. You click the buy and sell buttons yourself based on your analysis. Manual traders still benefit from stable connections, but they’re not dependent on automation.

Automated Trading (Expert Advisors/Robots)

Expert Advisors, or EAs, are basically robots that trade for you following rules written into their code. Set them up once on your platform, and they scan the market and place trades all day without you touching anything. At BigCloudy, we guarantee 99.9% uptime, ensuring your bots never stop working, even when your home setup fails.

Copy Trading

Copy trading lets you automatically replicate the trades of experienced investors in real time. You connect your account to a trader you trust, and their positions are copied to your account proportionally.

Scalping

Scalpers make dozens or hundreds of trades per day, holding positions for seconds or minutes to capture tiny price movements. Millisecond execution speed is non-negotiable here. Even a 50-millisecond delay can mean the difference between profit and loss when you’re trading on razor-thin margins.

Choosing The Right Platform

Your trading platform is your window into the forex market, so picking the right one matters. The platform you choose affects everything from the tools available to the stability of your connection during critical trades.

MetaTrader 4 (MT4): This platform leads the pack in forex trading. MT4 is simple to use, doesn’t drain your computer’s resources, and works with thousands of custom indicators and automated trading programs.

MetaTrader 5 (MT5): This newer version handles forex, stocks, commodities, and futures all in one place. MT5 gives you more timeframe options, stronger backtesting tools, and even has an economic calendar baked right into the platform.

Other Platforms: Certain brokers offer proprietary platforms or web-based trading options, yet MT4 and MT5 remain the benchmarks for professional traders.

If you want to compare different choices, check out our guide to the top forex trading apps that will help you make a smarter decision.

Additional Note: Mobile apps work great for checking alerts and making quick trades, but they can’t handle the heavy lifting of automated strategies or maintain the strong connection that real trading requires.

Why Do You Need a Forex VPS?

Once you understand the forex trading mechanism and how critical speed and stability are, the next logical step is ensuring your setup can actually deliver.

Home internet connections drop, power goes out, and computers restart for updates at the worst possible times. A Forex VPS server solves all of this by hosting your trading platform on a professional server that’s optimized specifically for forex trading.

Additionally, BigCloudy offers execution speeds under 3 milliseconds, zero downtime from power cuts or internet issues, and full accessibility from anywhere using Remote Desktop Protocol on your phone or tablet.

Forex Trading Risks and Risk Management

Forex offers exciting profit opportunities, but it also carries genuine risks that can rapidly diminish accounts.

- Leverage Risk: Brokers let you use leverage as high as 1:500, which multiplies your gains and also doubles your losses fast.

- Market Volatility: Currency values can shift dramatically in response to news releases, leading to erratic price movements.

- Over-Trading: Opening way too many positions at once spreads your money too thin and leaves you exposed to more risk than you can handle.

- Lack of Stop-Loss: Trading without stop-loss orders may result in account depletion in a single trade.

- Poor Money Management: Risking too much per trade makes recovery from losses mathematically impossible over time.

- Broker Risk: Unregulated or shady brokers can manipulate prices or refuse to process withdrawals properly.

Conclusion: Forex Trading Is The Process Of Buying and Selling Currency Pairs

Forex trading opens real doors to profit, but knowing the market alone won’t get you there. You also need an exceptional platform, smart risk controls, and a setup that won’t quit when the market keeps moving around the clock.

Most traders hit a wall not because they lack skill, but because their home setup can’t keep up. From understanding pips and spreads to choosing the right platform and managing risks, every decision impact.

Get the tools that match your ambition. Stay disciplined with your risk rules. Make sure your setup can actually deliver the performance this market demands.

If you’re serious about trading, explore VPS solutions designed specifically for forex.

FAQs

MetaTrader 4 keeps winning over beginners thanks to its simple layout, tons of tutorials, and support from practically every broker.

Manual traders may get by without it. Automated trading and scalping methods definitely need a VPS to ensure reliable uptime and minimal latency.

Mobile apps work great for monitoring and placing quick trades, but they lack the stability and features needed for serious automated trading.

Latency causes slippage, which means your orders get executed at prices worse than you expected. This eats directly into your profits and makes your losses bigger on every single trade.

MetaTrader 4 and MetaTrader 5 dominate the market, with cTrader and proprietary broker platforms like TradingView gaining popularity among specific trader groups.

A forex trading strategy includes entry and exit rules, risk management guidelines, position sizing, stop-loss levels, and clear profit targets.